On Sunday, Americans will mark the 100th birthday of Ronald Reagan. But for the conservative movement, the now-decades long hagiography project is reaching a crescendo. While the Gipper's former speechwriter Peggy Noonan lauded his goodness in the Wall Street Journal Friday morning, Sarah Palin kicked-off the Young Americans for Freedom three day extravaganza at the Reagan Library in California.

But while this weekend's anniversary will rightly celebrate Ronald Reagan's Cold War resolve, boundless optimism, and deep, abiding faith in the American people, the real lasting legacy of President Reagan will nowhere be on display. The father of the Republican Party's fiscal irresponsibility, Ronald Reagan made skyrocketing national debt, a dangerously reflexive aversion to taxes and a corrosive distrust of the people's government permanent fixtures of American politics.

- Ronald Reagan: The King of Debt

- Ronald Reagan: The Tax Cut Mythmaker

- Ronald Reagan: Undermining Trust in Government

A born-again convert to supply side economics, Ronald Reagan came to office in 1981 promising to simultaneously slash taxes, massively increase defense spending and balance the budget. Instead, as his budget director David Stockman acknowledged last year, Reagan produced red ink as far as the eye could see:

"[The] debt explosion has resulted not from big spending by the Democrats, but instead the Republican Party's embrace, about three decades ago, of the insidious doctrine that deficits don't matter if they result from tax cuts."

Which is exactly right. While the Republicans' fiscal rot deepened under George W. Bush, it began with Ronald Reagan. It was the legendary Gipper whose financial recklessness and tax-cutting fetish came to define the modern GOP.

The numbers tell the story. As predicted, Reagan's massive $749 billion supply-side tax cuts in 1981 quickly produced even more massive annual budget deficits. Combined with his rapid increase in defense spending, Reagan delivered not the balanced budgets he promised, but record-settings deficits. Even his OMB alchemist David Stockman could not obscure the disaster with his famous "rosy scenarios."

Forced to raise taxes twice to avert financial catastrophe (a fact conveniently forgotten in the conservative hagiography of Reagan manufactured by the GOP's 2008 ticket of John McCain and Sarah Palin), the Gipper nonetheless presided over a tripling of the American national debt. By the time he left office in 1989, Ronald Reagan more than equaled the entire debt burden produced by the previous 200 years of American history.

For his part, George H.W. Bush hardly stemmed the flow of red ink. And when Bush the Elder broke his "read my lips, no new taxes" pledge to address the cascading budget shortfalls, his own Republican Party turned on him. While Bush's apostasy helped ensure his defeat by Bill Clinton, it was Clinton's 1993 deficit-cutting package (passed without a single GOP vote in either house of Congress) which helped usher in the surpluses and economic expansion of the late 1990's.

Alas, they were to be short-lived. Inheriting a federal budget in the black and CBO forecast for a $5.6 trillion surplus over 10 years, President George W. Bush quickly set about dismantling the progress made under Clinton. Bush's $1.4 trillion tax cut in 2001, followed by a second round in 2003, accounted for half of the yawning budget deficits he produced. Bush's presidency nearly doubled the national debt And as the Center on Budget and Policy Priorities concluded last year, the Bush tax cuts if made permanent would contribute more to the U.S. budget deficit over the next decade than the Obama stimulus, the TARP program, the wars in Afghanistan and Iraq, and revenue lost to the recession - combined.

In 2001, Michael Kinsley marked Reagan's 90th birthday by noting, among other things, that when it came to small government, "this legendary Reagan revolution barely happened."

Federal government spending was a quarter higher in real terms when Reagan left office than when he entered. As a share of GDP, the federal government shrank from 22.2 percent to 21.2 percent--a whopping one percentage point. The federal civilian work force increased from 2.8 million to 3 million. (Yes, it increased even if you exclude Defense Department civilians. And, no, assuming a year or two of lag time for a president's policies to take effect doesn't materially change any of these results.)

As USA Today explained five years ago, measured as a percentage of gross domestic product, average annual federal spending dropped far more under Bill Clinton (-1.8%) than Ronald Reagan (-0.3%). As Kinsley put it:

Under eight years of Big Government Bill Clinton, to choose another president at random, the federal civilian work force went down from 2.9 million to 2.68 million. Federal spending grew by 11 percent in real terms--less than half as much as under Reagan. As a share of GDP, federal spending shrank from 21.5 percent to 18.3 percent--more than double Reagan's reduction, ending up with a federal government share of the economy about a tenth smaller than Reagan left behind.

Nevertheless, as Paul Krugman explained last July, Republican orthodoxy has remained unchanged since the time of Reagan. The GOP remains committed to "redo that voodoo":

It's not true, of course. Ronald Reagan said that his tax cuts would reduce deficits, then presided over a near-tripling of federal debt. When Bill Clinton raised taxes on top incomes, conservatives predicted economic disaster; what actually followed was an economic boom and a remarkable swing from budget deficit to surplus. Then the Bush tax cuts came along, helping turn that surplus into a persistent deficit, even before the crash.

But we're talking about voodoo economics here, so perhaps it's not surprising that belief in the magical powers of tax cuts is a zombie doctrine: no matter how many times you kill it with facts, it just keeps coming back. And despite repeated failure in practice, it is, more than ever, the official view of the G.O.P.

In 2002, Vice President Dick Cheney famously remarked, "Reagan proved deficits don't matter." Reagan himself long ago concluded the same thing:

"I am not worried about the deficit. It is big enough to take care of itself."

Arthur Laffer's supply-side snake oil has been Republican orthodoxy ever since Jude Wanniski first sketched Laffer's curve on a cocktail napkin. But in the wake of Reagan's disastrous supply side experiment, the GOP didn't merely suggest that tax cuts were the cure for everything from surpluses and deficits to erectile dysfunction and male pattern baldness. Despite the inescapable conclusion of empirical data and history to the contrary, Republicans continue to wrongly insist that "tax cuts pay for themselves." Sadly, the success of that poisonous propaganda has made talk of needed tax increases a non-starter.

To be sure, Reagan's heirs continue to ignore his mangled mantra that "facts are stubborn things." Last year, future House Speaker John Boehner was adamant that the Bush tax cuts were "not what led to the budget deficit." Jon Kyl (R-AZ) the second ranking Senate Republican made the same point another way, telling Chris Wallace of Fox News, "You should never have to offset cost of a deliberate decision to reduce tax rates on Americans." Aborted Obama Commerce nominee Judd Gregg (R-NH) soon chimed in, declaring "I tend to think that tax cuts should not have to be offset." For his part, Oklahoma's Tom Coburn argued his math will work in the future if you ignore the past, "Continuing the [Bush] tax cuts isn't a cost, if you added new taxes, new tax cuts, I would agree that's a cost." And on Wednesday, Senate Minority Leader Mitch McConnell explained how tax cuts magically turn red ink black:

"There's no evidence whatsoever that the Bush tax cuts actually diminished revenue. They increased revenue because of the vibrancy of these tax cuts in the economy. So I think what Senator Kyl was expressing was the view of virtually every Republican on that subject."

(Reviewing the Congressional Budget Office assessment of the hemorrhage of red ink produced by the Bush tax cuts, Ezra Klein joked that if a Democrat had made an assessment like Kyl's, "He'd be laughed out of the room.")

Unfortunately for America's financial health, George W. Bush wasn't laughed out of the room in when he declared, "You cut taxes and the tax revenues increase." Neither was John McCain when he reversed himself on Bush's tax cuts in 2006, wrongly announcing, "Tax cuts, starting with Kennedy, as we all know, increase revenues." Nor did Texas Senator Kay Bailey Hutchison pay a price for her 2009 regurgitation of Reagan's supply-side commandment:

"I think we get revenue the way we've done it in the past that has been so successful in the past and that is tax cuts...Every major tax cut we've had in history has created more revenue."

Perhaps the most lasting - and pernicious - legacy of Reagan's mythmaking on taxes is that raising them is now almost a political impossibility.

Despite their calls for spending cuts to reduce the federal deficit, Senate Republicans blocked legislation to create the national debt commission later authorized by an executive order from President Obama. John McCain explained why:

"I want a spending commission, and I worry that this commission could have gotten together and agreed to increase taxes. Spending cuts are what we need. We don't need to raise taxes."

Meanwhile, the Congressional Budget Office has already weighed in on the price tag for President Obama's tax cut compromise with Republicans in December. The deficit for this fiscal year is now estimated at $1.5 trillion. The increase is due to the $400 billion impact of the tax compromise, $70 billion of it to households earning over $250,000 a year. As for the overall tax burden, the CBO confirmed what the Bureau of Economic Analysis previously reported in May: "revenues would be just under 15 percent of GDP; levels that low have not been seen since 1950." As USA Today summed it up:

Federal, state and local taxes -- including income, property, sales and other taxes -- consumed 9.2% of all personal income in 2009, the lowest rate since 1950, the Bureau of Economic Analysis reports. That rate is far below the historic average of 12% for the last half-century. The overall tax burden hit bottom in December at 8.8% of income before rising slightly in the first three months of 2010.

"The idea that taxes are high right now is pretty much nuts," says Michael Ettlinger, head of economic policy at the liberal Center for American Progress.

Not to Ronald Reagan and his acolytes. As the Gipper often put it:

"The problem is not that people are taxed too little, the problem is that government spends too much."

Undermining Trust in Government

But that wasn't Reagan's only problem with government. "Government is not a solution to our problem," Ronald Reagan memorably remarked, "Government is the problem." Or he put it on another occasion:

"'The nine most terrifying words in the English language are: 'I'm from the government and I'm here to help.'"

During his response to President Obama's State of the Union address two weeks ago, Rep. Paul Ryan echoed Reagan:

"Limited government also means effective government. When government takes on too many tasks, it usually doesn't do any of them very well. It's no coincidence that trust in government is at an all-time low now that the size of government is at an all-time high."

Ryan is right that it's no coincidence that trust in government is at an all-time low. But the problem began with his party. And killing Americans' faith in government was a goal, not a side-effect, of Republican leadership.

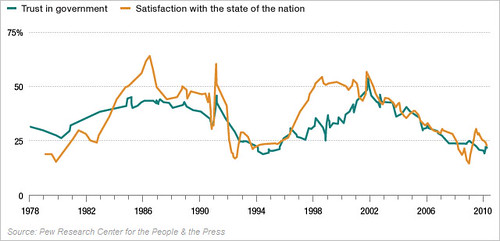

By 2007, Gallup surveys found that under President Bush, Americans' trust in the federal government had returned to lows not seen since Watergate. An April 2010 study by the Pew Research Center revealed that the trust in government which peaked over 50% after the 9/11 attacks had dipped below 25% by the time George W. Bush left office. By last spring, Pew's Andrew Kohut lamented, "Just 22% say they can trust the government in Washington almost always or most of the time, among the lowest measures in half a century."

As it turns out (and as the chart above shows), distrust of Washington is an American tradition which, as Ronald Reagan and Bill Clinton learned, tends to rise and fall inversely with the economy. But for Republicans' undermining Americans' faith in government is no accident. Since the time of Reagan, it's been an essential political strategy.

By now, the Republican recipe should be all too familiar. First is to endlessly insist that, as Ronald Reagan famously said, "Government is the problem." Second is the self-fulfilling prophecy of bad government under Republican leadership, as the Bush recessions of 1991 and 2007, the Hurricane Katrina response, the Iraq catastrophe and the transfer of federal oversight powers to the industries being regulated all showed. Third, when the backlash from the American people inevitably comes as it did in 1992 and 2008, attack the very legitimacy of the new Democratic president they elected. Fourth, turn to the filibuster and other obstructionist tactics to block the Democratic agenda, inaction for which the incumbent majority will be blamed. Last, target the institutions and programs (Social Security, Medicare, the IRS) which form the underpinnings of progressive government.

Then lather, rinse and repeat.

It's no wonder Pew's Kohut concluded, "Record discontent with Congress and dim views of elected officials generally have poisoned the well for trust in the federal government." And, sadly, catapulted Republicans to record gains in the 2010 midterm elections.

"Poisoning the well" is a fitting description for decades of Republican politics.

Author and Wall Street Journal columnist Thomas Frank is probably best known for What's the Matter with Kansas, which documents the Republicans' proven success in using social wedge issues to lead working Americans to vote against their economic self-interest. But in was in his subsequent book, The Wrecking Crew, in which Frank laid out the tried and true Republican formula for breaking - then retaking - government beginning with the Reagan Revolution. As it turns out, the failure of conservatives to govern isn't a bug, it's a feature:

"The chief consequence of the conservatives' unrelenting faith in the badness of government is...bad government...

...And remember. None of it is accidental. These are the fruits of the free market theory of government."

As 1930's Labor Department lawyer Carl Auerbach once put it, "You cannot run on a platform that government is the problem and expect the best people in the country to want to be a part of the problem."

Once upon a time, Ronald Reagan probably believed that, too. After all, he was once a Democrat and a fervent supporter of the New Deal. But Americans won't be hearing much about that part of the Reagan story this weekend. And as the Gipper turns 100, his triple legacy of debt, defunding and distrust will doubtless go unmentioned as well.

(This piece also appears at Perrspectives.)

NOTE: For more analysis of Ronald Reagan the man and the myth, see the columns from Tear Down This Myth author Will Bunch in the Washington Post and CNN.