On Thursday, House Speaker John Boehner peppered his address to the Economic Club of Washington with a dozen mentions of America's so-called "job creators." But in claiming that high taxes and unnecessary regulations have "pummeled" his supposed job producers, Boehner willingly misrepresented the source of and solutions to the nation's economic problems. After all, recent surveys show that regulations and taxes are not killing small business. With corporations flush with cash and the total federal tax burden at a 60 year low, the U.S. instead faces a demand crisis fueled by staggering household debt.

But John Boehner perpetrated the biggest fraud of his address when he declared, "Job creators in America are essentially on strike." If so, they've been on the picket line for a decade. As it turns out, George W. Bush's tax breaks for the wealthy sadly coincided with the worst period of job creation of any president since Herbert Hoover.

Like his lieutenant Eric Cantor, John Boehner has been regurgitating the "job creators" talking point for months. (Arguably, the sound bite dates back to 1993, when Republicans deployed the same "job killing" language against the Clinton upper-income tax increases that preceded the 1990's economic boom.) In May, Boehner served up the "job creators" line seven times in a speech to the Economic Club of New York. Contending that "the mere threat of tax hikes causes uncertainty for job creators -- uncertainty that results in less risk-taking and fewer jobs," Speaker Boehner explained that same month just who his magical job creators are:

"The top one percent of wage earners in the United States...pay forty percent of the income taxes...The people he's [President Obama] is talking about taxing are the very people that we expect to reinvest in our economy."

If so, those expectations were sadly unmet under George W. Bush. After all, the last time the top tax rate was 39.6 percent during the Clinton administration, the United States enjoyed rising incomes, 23 million new jobs and budget surpluses. Under Bush? Not so much.

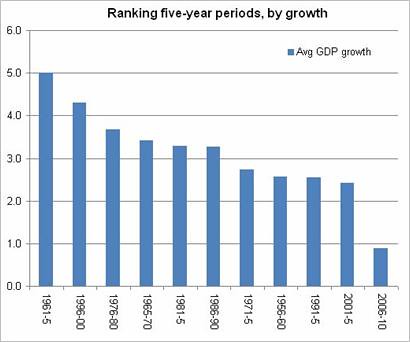

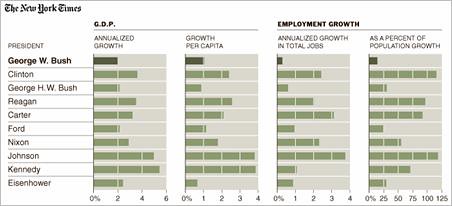

On January 9, 2009, the Republican-friendly Wall Street Journal summed it up with an article titled simply, "Bush on Jobs: the Worst Track Record on Record." (The Journal's interactive table quantifies his staggering failure relative to every post-World War II president.) The meager one million jobs created under President Bush didn't merely pale in comparison to the 23 million produced during Bill Clinton's tenure. In September 2009, the Congressional Joint Economic Committee charted Bush's job creation disaster, the worst since Hoover:

That dismal performance prompted David Leonhardt of the New York Times to ask last fall, "Why should we believe that extending the Bush tax cuts will provide a big lift to growth?" His answer was unambiguous:

Those tax cuts passed in 2001 amid big promises about what they would do for the economy. What followed? The decade with the slowest average annual growth since World War II. Amazingly, that statement is true even if you forget about the Great Recession and simply look at 2001-7...

Is there good evidence the tax cuts persuaded more people to join the work force (because they would be able to keep more of their income)? Not really. The labor-force participation rate fell in the years after 2001 and has never again approached its record in the year 2000.

Is there evidence that the tax cuts led to a lot of entrepreneurship and innovation? Again, no. The rate at which start-up businesses created jobs fell during the past decade.

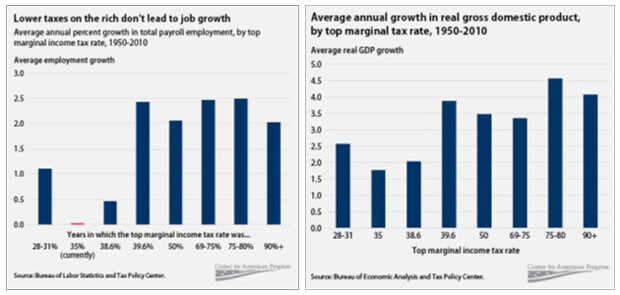

The data are clear: lower taxes for America's so called job-creators don't mean either faster economic growth or more jobs for Americans.

It's no wonder Leonhardt followed his first question with another. "I mean this as a serious question, not a rhetorical one," he asked, "Given this history, why should we believe that the Bush tax cuts were pro-growth?" Or as Mark Shields asked and answered in April:

"Do tax cuts help 'job creators' or 'robber barons'?"

Just days after the Washington Post documented that George W. Bush presided over the worst eight-year economic performance in the modern American presidency, the New York Times in January 2009 featured an analysis comparing presidential performance going back to Eisenhower. As the Times showed, George W. Bush, the first MBA president, was a historic failure when it came to expanding GDP, producing jobs and even fueling stock market growth. Apparently, America's job creators can create a lot more jobs when their taxes are higher - even much higher - than they are today.

(It's worth noting that the changing landscape of loopholes, deductions and credits, especially after the 1986 tax reform signed by President Reagan, makes apples-to-apples comparisons of effective tax rates over time very difficult. For more background, see the CBO data on effective tax rates by income quintile.)

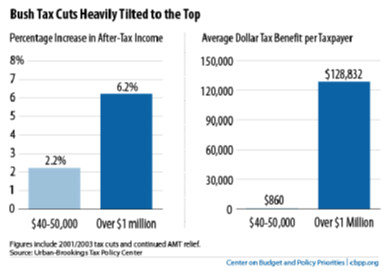

The epic failures of the Bush tax cuts for America's supposed job creators hardly end there. The U.S. poverty rate began rising in 2005, well before the onset of the December 2007 Bush recession. As David Cay Johnston document, average household income fell after the Bush tax cuts of 2001 and 2003, dropping to about $58,500 in 2008 from $61,500 in 2000. The Center on Budget and Policy Priorities (CBPP) found that the Bush tax cuts accounted for almost half of the mushrooming deficits during his tenure, and, if made permanent, over the next 10 years would contribute more to the U.S. budget deficit than the Obama stimulus, the TARP program, the wars in Afghanistan and Iraq, and revenue lost to the recession put together. As the data show, the Bush tax cuts provided a massive payday for the wealthy, helping fuel record income inequality.

For Republicans, this predictable result of the Bush tax cuts was a feature, not a bug. As the Center for American Progress noted in 2004, "for the majority of Americans, the tax cuts meant very little," adding, "By next year, for instance, 88% of all Americans will receive $100 or less from the Administration's latest tax cuts." But that was just the beginning of the story. As the CAP also reported, the Bush tax cuts delivered a third of their total benefits to the wealthiest 1 percent of Americans. And to be sure, their payday was staggering. The Center on Budget and Policy Priorities showed that millionaires on average pocketed almost $129,000 from the Bush tax cuts of 2001 and 2003.

Despite that record failure, House Republicans want to give the job creators who don't create jobs another jaw-dropping tax cut.

In May, Speaker Boehner and House Republicans updated their "Pledge to America" with another gilded-class giveaway they called their "Plan for America's Job Creators." As Ezra Klein, Paul Krugman and Steve Benen among others noted, the "Plan for America's Job Creators" is simply a repackaging of years of previous proposals and GOP bromides. (As Klein pointed out, the 10 page document "looks like the staffer in charge forgot the assignment was due on Thursday rather than Friday, and so cranked the font up to 24 and began dumping clip art to pad out the plan.") At the center of it is the same plan from the Ryan House budget passed in April to cut the top individual and corporate tax rates to 25%.

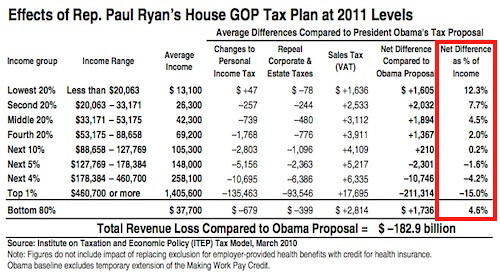

The price tag for the Republican proposal is a jaw-dropping $4.2 trillion. And as Matthew Yglesias explained, earlier analyses of similar proposals in Ryan's Roadmap reveal that working Americans would have to pick up the tab left unpaid by upper-income households:

This is an important element of Ryan's original "roadmap" plan that's never gotten the attention it deserves. But according to a Center for Tax Justice analysis (PDF), even though Ryan features large aggregate tax cuts, ninety percent of Americans would actually pay higher taxes under his plan.

In other words, it wasn't just cuts in middle class benefits in order to cut taxes on the rich. It was cuts in middle class benefits and middle class tax hikes in order to cut taxes on the rich. It'll be interesting to see if the House Republicans formally introduce such a plan and if so how many people will vote for it.

If this all sounds hauntingly familiar, it should. When it comes to using the tax code to line the pockets of the wealthiest people in America, John Boehner and Congressional Republicans simply want the next decade to look like the last one. That is, gargantuan tax cuts for America's so-called "job creators"; no jobs for Americans.

(This piece also appears at Perrspectives.)