At a $1.7 million fundraiser in Jackson, Mississippi this week, Republican presidential nominee Mitt Romney declared that the GOP is not "the party of the rich," insisting instead that "we're the party of people who want to get rich."

Sadly for Romney, there are two small problems with his assessment. For starters, Mitt's proposals (like those from GOP wunderkind Paul Ryan) would deliver another massive tax cut windfall for the wealthy and shred the social safety net while putting the economic recovery at risk. Just as damning for Mitt and his cheerleaders like David Brooks and Robert Samuelson, the historical record shows that from economic growth and job creation to household incomes, stock market performance and just about every other indicator of the health of the U.S. capitalism, the modern U.S. economy has almost always done better under Democratic presidents.

Nevertheless, Governor Romney offered his GOP extreme makeover during his audience with the haves and have-mores in Mississippi. As ABC reported:

"We're accused, by the way -- in our party -- of being the party of the rich," Romney said. "And it's an awful moniker, because that's just not true. We're the party of people who want to get rich. And we're also the party of people who want to care to help people from getting poor. We want to help the poor."

Americans have good reason to look the dressage horse in the mouth, and not just because earlier this year Romney announced, "I'm not concerned about the very poor." As it turns out, Mitt Romney's program makes George W. Bush look like Karl Marx.

At a time of record income inequality, the lowest federal tax burden in 60 years and plummeting effective tax rates for the top one percent of earners, Romney is promising a staggering payday for the gilded-class. Mitt Romney doesn't merely want to make the Bush tax cuts permanent: he wants to end the AMT and another 20 percent across the board tax cut that could reduce his own future tax bills by half. All told, the Center for American Progress forecast Romney would hand over 60 percent of the benefits from his tax cuts to the top one percent of earners. (And that figure was before he announced his new 20 percent across-the-board tax cut scheme reflected in the chart above.)

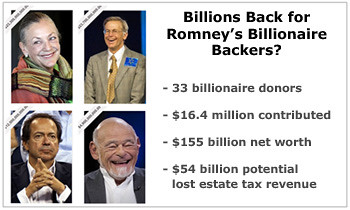

That Romney wants to maintain the notorious "carried interest exemption" that allows him to pay 15--and not 35 percent--on his millions in continuing income from Bain Capital may explain why the giants of private equity like Henry Kravis, Julian Robertson, John Paulson, Marc Rowan and Sam Zell are pouring money into his Super PAC. Making matters worse, Romney's plans to slash the corporate income tax and shift to a "territorial" system to treat the foreign revenue of American firms could cost the Treasury $1 trillion and the United States an estimated 800,000 jobs.

But one Romney proposal above all others - the elimination of the estate tax - offers a staggering ROI for the richest families in America.

In 1999, that tax was 55% on an individual's estate valued at over $675.000. Thanks to President Obama's capitulation to Congressional Republicans in December 2010, the estate tax dropped to 35 percent starting at $5 million per person, and now impacts less than 0.25 percent of estates. Now, Mitt Romney wants to eliminate that levy altogether, one that brings Uncle Sam billions in revenue annually. The result will be billions back for Romney's billionaire backers like Sheldon Adelson, Bill and Richard Marriott, Charles and David Koch, and Walmart's Walton family.

But what President Romney would giveth to the rich, he wants to taketh away from everyone else.

Like the Paul Ryan budget backed by 235 House Republicans and 40 GOP Senators, Romney's plan pays for its winner-take-all tax cuts by gutting the social safety net he pretends to protect. Both Romney and Ryan would end Medicare as we know it with a premium support gambit that would dramatically shift health care costs to America's seniors. While increasing defense spending, the House Budget Chairman and the GOP White House hopeful would repeal the Affordable Care and leave as many as 48 million more people without insurance. (And despite their mutual pledges to end many tax loopholes and deductions to fund their gilded-class giveaway, neither Paul Ryan nor Mitt Romney has the courage to say which ones. As a result, these supposed deficit hawks would actually add trillions more in red ink to the national debt.)

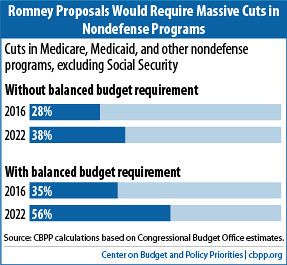

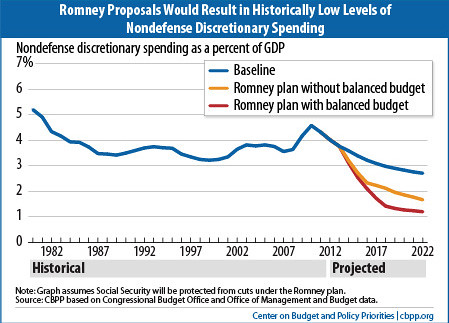

As an analysis from Center on Budget Policy and Priorities suggests, Mitt Romney wasn't lying when he said, "I'm not concerned about the very poor." And despite having declared himself part of "the 80 to 90 percent of us" who are middle class. Romney's own economic plan says otherwise.

Despite his pledges to the contrary, Romney's isn't worried about fixing the safety net; he wants to shred it. And in December, Chris Wallace of Fox News called him on it.

WALLACE: But you don't think if you cut $700 billion dollars in aid to the states that some people are going to get hurt?

ROMNEY: In the same way that by cutting welfare spending dramatically, I don't think we hurt the poor. In the same way I think cutting Medicaid spending by having it go to the states run more efficiently with less fraud, I don't think will hurt the people that depend on that program for their healthcare.

The Congressional Budget Office says otherwise. Looking at Ryan's similar version of shredding the safety net, the CBO estimates 48 million Americans would lose health insurance (32 million from repeal of the Affordable Care Act, 15 million from Medicaid cuts, and another one million from the voucherization of Medicare). It's with good reason Ezra Klein asked, "Should the poor pay for deficit reduction?"

As it turns out, it's not just the poor who will pay for Romney's draconian cuts to nondefense spending. Many leading economists predict that far from rescuing the middle class, Mitt Romney will only batter it further. Joel Prakken, chairman of economic forecasting firm Macroeconomic Advisers, rejected the notion that Mitt's 159 point plan would "reduce the unemployment rate from eight to five in two years." James Galbraith worried that" if applied, these fiscal measures would be utterly draconian" and "the attacks on Medicare and Social Security would throw large portions of the population into poverty." Mark Hopkins of Moody's Analytics stated that "on net, all of [Romney's] policies would do more harm in the short term," adding, "If we implemented all of his policies, it would push us deeper into recession and make the recovery slower." As Nobel Prize-winning economist Joseph Stiglitz put it:

"The Romney plan is going to slow down the economy, worsen the jobs deficit, and significantly increase the likelihood of a recession."

Stiglitz' fellow Nobel winner Paul Krugman explained it this way. "Ireland is Romney economics in practice. I think Ireland is America's future if Romney is president."

Mitt Romney's mythmaking notwithstanding, his policies show that the Republican Party is indeed the party of the rich. As for the people who want to get rich, in 2012 they should follow the same wise advice Harry Truman gave over 60 years ago:

"If you want to live like a Republican, vote Democratic."

For more details explaining why, see "Sorry, Mitt: If You Want to Live Like a Republican, Vote Democratic."

(This piece also appears at Perspectives.)