In other words spend, spend, spend - and provide some principal reduction for underwater homeowners.

Bad News

We won't recap all the employment figures in today's jobs report, since they're available elsewhere. We'll stick to the highlights:

A key figure is essentially unchanged: There are 12.7 million unemployed people in this country.

Also unchanged, or only slightly changed: Unemployment rate for adult men is 7.6 percent, for when it's 7.4 percent, for teenagers it's 25 percent, for white people it's 7.3 percent, and for Asian it's 6.2 percent. Hispanics are still suffering with 10.3 percent unemployment, and for African Americans the rate remains a stunningly high 14 percent.

But then, all of these figures are stunningly high.

The crisis in long-term unemployment persists, with 5.3 million people among the long-term jobless. There was a drop in the number of people who want full-time work but can't get it, but it remains extremely high at 8.1 million.

Wait. It Gets Worse

And unemployment isn't our only national burden. Income gains have been very weak, and that segment of the workforce that actually is working is increasingly finding itself in low-paying jobs. And analysts are expect low earnings reports for corporate America, starting next week, as the sluggish economy takes its toll on publicly-traded companies.

Meanwhile banks, high off the settlement deal that protects them from criminal prosecution for illegal foreclosures, are expected to begin another wave of foreclosures that will send housing prices plummeting even further and costing local communities even more in lost revenue.

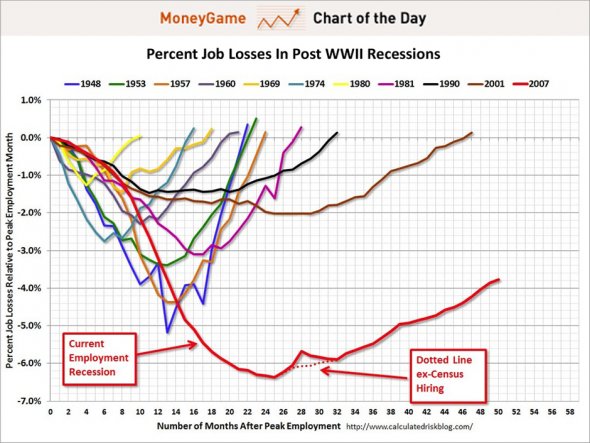

Experts were stunned by the low figures. The consensus was that 205,000 new jobs would be created this month, but only 120,000 were. Moral #1? Don't trust the consensus. Moral #2? Even 205,000 isn't nearly enough to fix our unemployment problem and get the economy moving again:

It's time to start thinking about real solutions to this problem. There are two:

Spend Spend Spend

The stimulus worked, but it wasn't big enough. Far too much of the package was devoted to nonproductive tax cuts for the wealthy, and far too little on direct spending that creates jobs. So we need more direct spending on infrastructure - and, as Dave Johnson notes, we also need it if we don't want our country to keep falling apart at the seams.

The President recently observed that restoring jobs in construction and in state and local government at the same rate they experienced during previous recessions would reduce the overall unemployment rate to 6 percent, and some economists think that figure is low.

The CBO estimates that the last round of direct stimulus spending of $300 billion created 1.4 million jobs. We need to spend at least that much again, and we need to restore Federal support for state and local budgets.

Underwater Rescue

Another way to get the economy moving is to get financial relief to people who have been financially struggling and have put off needed spending - on vehicles, home improvements, and the like - as well as reasonable amenities.

Homeowners owe $800 billion in "negative equity" to banks for non-existent real estate value. That's an "invisible bailout" funded by the struggling middle class, and delivered by borrowers who were frequently hoodwinked into taking out a mortgage at inflated pricies.

Principal relief of $300 billion or thereabouts would be just, fair -- and would create a lot of jobs.

Action Time

There you have it. So can we stop talking about government deficits until this problem is fixed? Some of us think Simon Johnson's emphasis on government debt is premature - let's get the economy moving and pivot to deficits afterwards - but he's certainly right when he says that "Our modern debt surge is much more about declining federal government revenue than it is about runaway spending."

So let's tax the wealthy, help homeowners, and spend some money to put more people back to work. When that's done we can pivot to deficit reduction - with millions of additional workers able to contribute to that effort with their taxes.

If reports are true that the President's game plan is to make his re-election campaign "all about Republicans," I would respectfully suggest a change of direction. It should be "all about jobs."

So what's keeping you, Washington? Stop the silly talk about "Simpson/Bowles" and "Grand Bargains" and get to work. The nation's unemployed, underemployed, and underpaid have waited long enough.