Europe's economic depression has now lasted longer than the Great Depression of the 1930s. Meanwhile, America's "Great Recession" also drags on thanks to cutbacks in government spending since the stimulus.

Europe's leaders somehow were convinced that austerity – "deficit reduction" through cutbacks in government – would somehow lead them out of their economic doldrums. They believed that taking money out of the economy would help the economy. The result has been terrible. The Washington Post's Wonkblog calls Europe's austerity-lengthened depression "one of the biggest catastrophes in economic history."

To top it off, Europe's governments are learning that cutting back on spending not only worsens the economic picture, causing terrible unemployment, poverty and human misery, but the worsened economic picture means less revenue coming in, thereby increasing deficits instead of lowering deficits. In other words, austerity cutbacks to fight deficits have instead made deficits worse and hurt people.

Europe's Policy-Driven Depression

In "Worse than the 1930s: Europe’s recession is really a depression," Matt O'Brien writes,

It's a policy-induced disaster. Too much fiscal austerity and too little monetary stimulus have crippled growth like almost never before. Europe is doing worse than Japan during its "lost decade," worse than the sterling bloc during the Great Depression, and barely better than the gold bloc then—though even that silver lining isn't much of one. That's because, at this rate, it'll only be another year until the eurozone is well behind the gold bloc, too.

In Wonkblog's chart, the black line shows Europe's negative GDP doldrums since 2007.

The harmful effect of austerity is so obvious that even Europe's policymakers are starting to get it. The New York Times, in "France Acknowledges Economic Malaise, Blaming Austerity," reports that, "President François Hollande on Wednesday ... indicated that the austerity policies France had been compelled to adopt to meet the eurozone’s budget deficit targets were making growth impossible."

“The diagnosis is clear,” Mr. Hollande said in an interview published Wednesday in the French daily Le Monde. “Due to the austerity policies of the last several years, there is a problem of demand throughout Europe, and a growth rate that is not reducing employment.”

It was the most public rejection by France of the austerity medicine that Germany has long prescribed for the eurozone — which even the German chancellor, Angela Merkel, recently acknowledged might be impeding the currency bloc’s recovery.

(Click here for a Businessweek/Bloomberg video in which Economist Joseph Stiglitz explains why Europe's austerity has been a "dismal failure" and needs a change of approach.)

Demand Drives An Economy

Here's the deal. In a slowdown consumers and businesses are not bringing enough "demand" to an economy. This lack of customers causes businesses to lay off workers and those workers stop being consumers, so businesses have to cut back even more. So they lay off workers and those workers stop being consumers, so businesses have to cut back even more. You get the picture: "Death spiral."

This is when government (We the People) should step in. In the 20th century we learned a way out of recessions and depressions. During slowdowns government can spend, and this boosts the demand in the economy to make up for the demand shortfall from consumers and businesses. Government can invest in infrastructure, causing construction workers to be hired and suppliers of equipment and materials to thrive. Government can spend on things it needs like equipment and cars, etc. Government can hire to get things done that need to be done like teaching kids, daycare, adding police and firefighters ... so many things.

And all of those thing help make the lives of We the People better in the long run. Good, modern infrastructure, schools and teachers, universities, police, firefighters, parks, libraries, courts, scientific research, environmental protection, food inspectors, job-safety inspectors and all the rest of the things government does make our lives better – and boost our economy in the long term.

Stimulus Helped The U.S. Economy, Deficit-Cutting Hurt

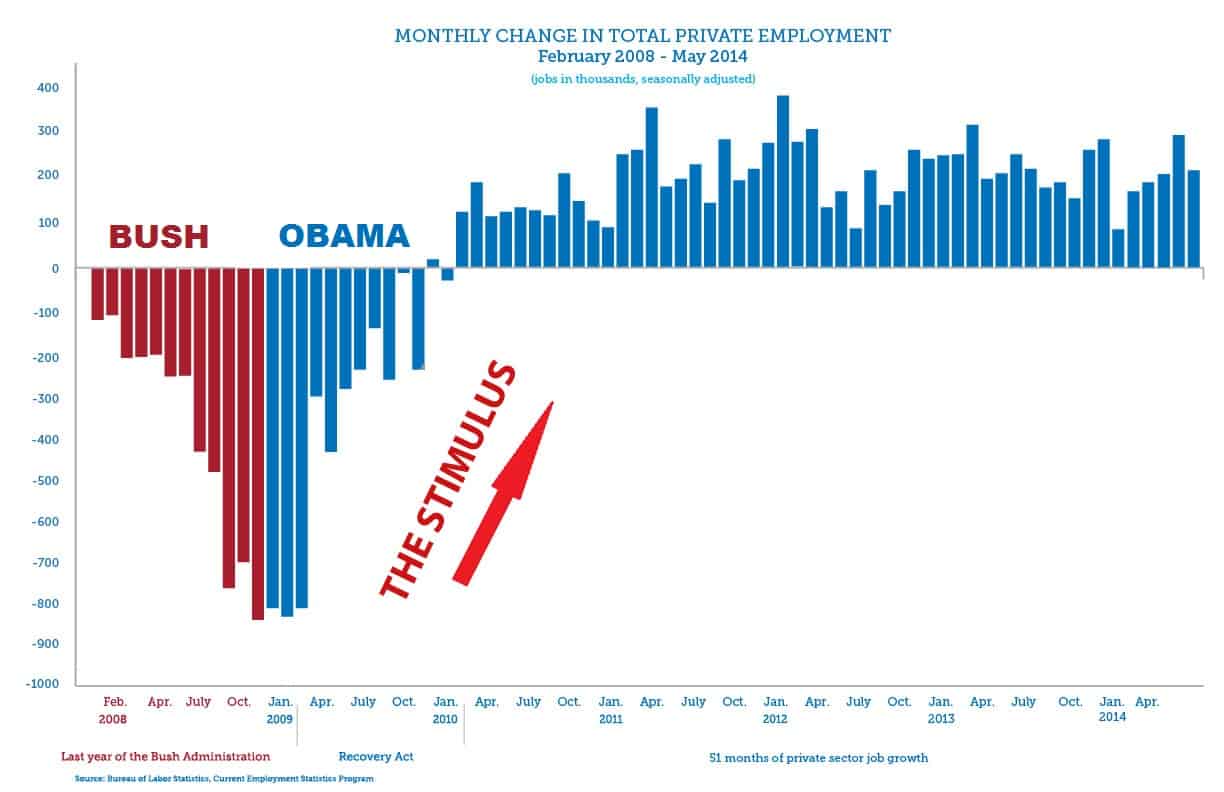

Just after President Obama took office there were enough Democrats in the House and Senate to pass the "stimulus." This was the result:

Unfortunately Republicans gained seats in the Senate and have filibustered every single attempt to help the economy since. The post Three Updated Charts to Email to Your Right-Wing Brother-In-Law explains how this has hurt us,

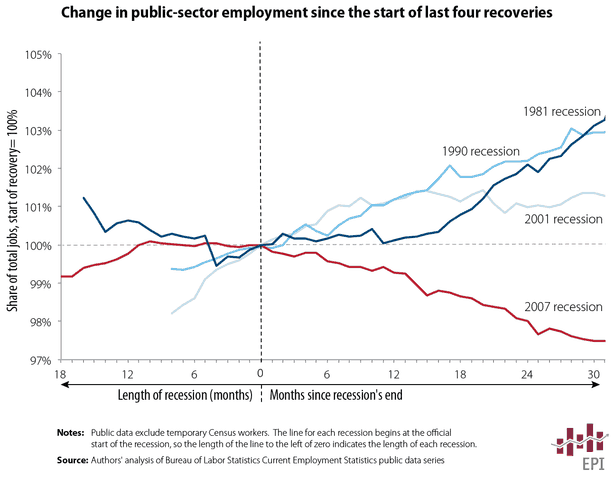

Government spending does not “take money out of the economy.” In fact it puts money into the economy, creates jobs and lays the foundation for future prosperity. ... this chart from The Atlantic, “The Incredible Shrinking U.S. Government,” shows how government spending to create government jobs helped us get out of the 1981, 1990 and 2001 recessions. But since the 2007 “Great Recession,” we instead have laid off hundreds of thousands of government employees, obviously making unemployment even worse.

... This chart from Roger Hickey’s post, Continued Jobs Growth. But Highway Bill Shows Austerity Still Hurts., shows how “conservative budget cutting has undermined growth from mid-2010 through 2014″:

“As you can see, the impact of austerity on the economy is projected to be reduced over the next two quarters, but the next budget is not expected to be expansionary – and Republicans are still writing budgets under the mistaken conservative theory that spending cuts somehow stimulate growth.”

Government spending obviously helps boost a flagging economy. Cutting government spending during a slowdown obviously takes badly needed money out of the economy at the very times it needs the help.

Some Believe Government Is Bad And "Markets" Should Make The Decisions

There are those who think that it is wrong for government (We the People) to be able to do things like this, and these decisions should be left to "the market." They want "limited government" and demand that government get "out of the way" of "the market" – i.e. those with money – and let the big corporations and the billionaires behind them make the decisions, not We the People.

Terms like "the market" and "free enterprise" is modern wording applied to the age-old fight between those who already have great wealth and power, and regular people who are powerless unless they are able to band together in democracy to protect each other from the power of the wealthy.

The thing is, the "private sector" is the very sector that is in a downward spiral during slowdowns. Without an outside force – government – stepping in to boost demand there is nothing to interrupt the downward spiral. "Austerity" cutbacks in government literally take money out of the economy. Austerity cuts back on maintaining the infrastructure and teachers and police and firefighters and construction workers and scientific research – all at the very time that businesses are also laying people off.

We have seen this in the United State because of budget cuts forced by Republicans – especially the "sequester" forced by the debt-ceiling standoff. But in Europe, the austerity has been much worse than here, and the result have been much more devastating to Europe's economy and people.

We can only hope that Europe's leaders are starting to get it that taking money out of the economy takes money out of the economy.

-----

This post originally appeared at Campaign for America's Future (CAF) at their Blog for OurFuture. I am a Fellow with CAF. Sign up here for the CAF daily summary and/or for the Progress Breakfast.