Ry Cooder: "No Banker Left Behind"

"On television, in interviews and in meetings with investors, executives of the biggest U.S. banks -- notably JPMorgan Chase & Co. Chief Executive Jamie Dimon -- make the case that size is a competitive advantage. It helps them lower costs and vie for customers on an international scale. Limiting it, they warn, would impair profitability and weaken the country’s position in global finance."

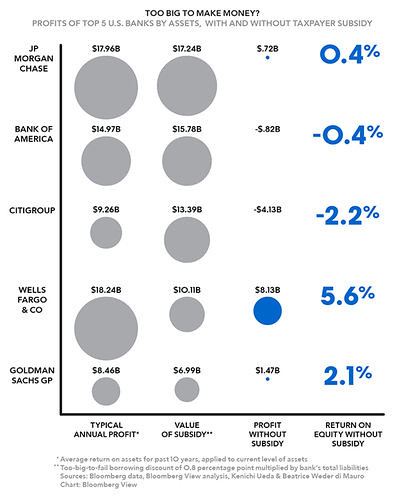

"So what if we told you that, by our calculations, the largest U.S. banks aren’t really profitable at all? What if the billions of dollars they allegedly earn for their shareholders were almost entirely a gift from U.S. taxpayers?"

"Small as it might sound, 0.8 percentage point makes a big difference. Multiplied by the total liabilities of the 10 largest U.S. banks by assets, it amounts to a taxpayer subsidy of $83 billion a year. To put the figure in perspective, it’s tantamount to the government giving the banks about 3 cents of every tax dollar collected."

Three cents out of every tax dollar the government collects from you is pocketed by the Big Banks on Wall Street. Let's take a look at that permanent, yearly bailout:

[Illustration by Bloomberg View]

I'm not surprised to learn that Wall Street and their wealthy investors are "too big" to earn their own profits, too. I just had no idea we were being fleeced on such a grand scale.

Full Bloomberg editorial here.