Even at a time of record income inequality, the lowest federal tax burden in 60 years and plummeting effective tax rates for the top one percent of earners, it is often difficult to put a face on the yawning chasm between the super-rich and everyone else. But now we have six. New data from the Federal Reserve reveal that the heirs of Walmart founders Sam and James "Bud" Walton now possess total wealth equivalent to 49 million American families, 42 percent of the total. As it turns out, that shocking number will grow much larger if Mitt Romney wins in November. After all, would-be President Romney not only wants to deliver another massive tax cut windfall for the wealthy, but wants to eliminate the estate tax altogether, a move that on paper would divert over $30 billion from the U.S. Treasury into the vaults of the Walton family.

Back in the fall of 2007, Walmart chief financial officer Tom Schoewe told Wall Street analysts, "Tough times are actually a good time for Walmart." Now we know just how good.

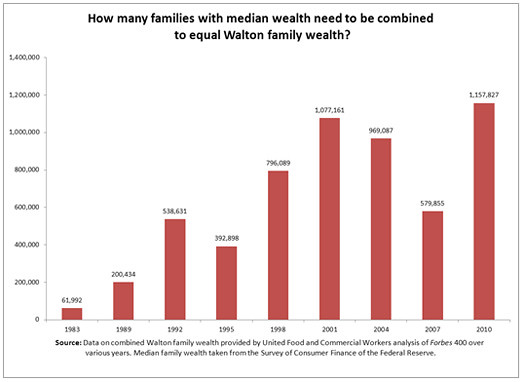

As labor economist Sylvia Allegretto of the University of California and Josh Bivens of the Economic Policy Institute documented this week, the Fed's Survey of Consumer Finances (SCF) showed that the crippling recession which began five years ago has been a bonanza for the Walton Six. Between 2007 and 2010, the wealth of the Walton family members jumped from $73.3 billion to $89.5 billion even as median family wealth fell by 38.8 percent. The result?

In 2007, it was reported that the Walton family wealth was as large as the bottom 35 million families in the wealth distribution combined, or 30.5 percent of all American families.

And in 2010, as the Walton's wealth has risen and most other Americans' wealth declined, it is now the case that the Walton family wealth is as large as the bottom 48.8 million families in the wealth distribution (constituting 41.5 percent of all American families) combined.

Apparently, that's not enough for the Waltons. Which is why they along with dozens of other billionaires are backing Mitt Romney, big time.

As you'll recall, Mitt Romney doesn't merely want to make the Bush tax cuts permanent: he wants to end the AMT and enact another 20 percent across the board tax cut that could reduce his own future tax bills by half. But one Romney proposal above all others - the elimination of the estate tax - offers a staggering ROI for the richest families in America.

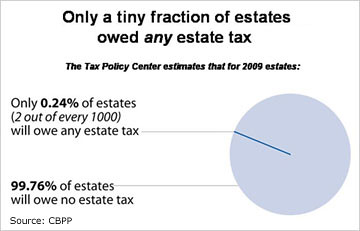

In 1999, that tax was 55% on an individual's estate valued at over $675.000. Thanks to President Obama's capitulation to Congressional Republicans in December 2010, the estate tax dropped to 35 percent starting at $5 million per person. (Despite the fact that only 0.25 percent of estates even had to pay the tax, Democrat Blanche Lincoln, also once known as the "Senator from Walmart," colluded with Arizona Republican Jon Kyl to force the lower rate.) Now, Mitt Romney wants to eliminate that levy altogether, one that brings Uncle Sam billions in revenue annually.

The result will be billions back for Romney's billionaire backers. On paper, Sheldon Adelson's heirs will keep $8.75 billion (35 percent of his estimated $25 billion fortune) currently destined for the U.S. Treasury. The beneficiaries of Richard and Bill Marriott, the hotel moguls worth an estimated $3.3 billion between them, would reap an extra $1.15 billion payday. Then there's Alice and Jim Walton, who are in a class by themselves. For their combined $400,000 contribution to Romney's Super PAC, their Walmart heirs could get back 81,750 times on Alice and Jim's original investment.

As Forbes first highlighted last year, between them the six Waltons combined have over $90 billion. As Vermont Senator Bernie Sanders explained in his famous filibuster of December 2010, the elimination of the estate tax could potentially save the Walton family $32.7 billion. As it turns out, President Romney's zeroing out of the estate tax would cap a years-long effort for the Waltons. USA Today summed it up in 2005:

Led by Sam Walton's only daughter, Alice, the family spent $3.2 million on lobbying, conservative causes and candidates for last year's federal elections. That's more than double what it spent in the previous two elections combined, public documents show.

The Waltons have joined a coterie of wealthy families trying to save fortunes through permanent repeal of the estate tax, government watchdogs say. The election of President Bush and more conservatives to Congress gave momentum to the long-fought effort. The Waltons add more.

A Republican victory this fall could bring Alice Walton's crusade to fruition. And if she succeeds, the gaping multi-billion hole left in the U.S. Treasury will have to be filled by all the other taxpayers in America. Or as the Waltons call them, Walmart customers.

(This piece also appears at Perrspectives.)