When the Romney campaign alerted users of its mobile VP app on Tuesday to "turn on your push notifications," the GOP vice presidential frenzy went to 11. But while New York Times statistician extraordinaire Nate Silver responded by running simulations to reveal which potential Romney running mate might help him most, conservative Republicans increasingly began pushing one--Wisconsin Rep. Paul Ryan--who might help him least.

But whether or not Mitt Romney ultimately chooses as his #2 the man Charles Pierce calls the "zombie-eyed granny starver" is almost beside the point. That's because on the issues that matter most, Governor Romney and Budget Chairman Ryan are offering virtually the same dangerous prescription for America's future. As Stephen Hayes and Bill Kristol put it in the headline of their Weekly Standard paean to Paul:

“It's the Romney-Ryan Plan; Why Not Romney-Ryan Ticket?”

Hayes and Kristol certainly got the first part right. Both Ryan and Romney would deliver a massive tax cut windfall for the rich, a multi-trillion giveaway offset only in part by gutting the social safety net each pretends to protect. Romney-Ryan ends Medicare as we know it with a "premium support" gambit that would dramatically shift health care costs to America's seniors. Their shared call for repealing the Affordable Care Act could leave up to 48 million more people without health insurance. Even as their draconian austerity budgets would increase unemployment beginning in 2013, both men would nevertheless ratchet up defense spending. And despite their mutual pledges to end many tax loopholes and deductions to fund their gilded-class giveaway, neither Paul Ryan nor Mitt Romney has the courage to say which ones. As a result, these supposed deficit hawks would actually add trillions more in red ink to the national debt.

As Paul Begala summed up the Romney-Ryan program, "This is not like some crackpot theory from some long dead Russian immigrant." No, it is not. And no matter who emerges as the GOP's vice presidential pick, the Republican Party has already bought the Romney-Ryan ticket to the White House.

Here, then, is an overview of the Romney-Ryan plan. (Click a link below to jump to the details for each.)

- Massive Tax Cuts for the Rich

- Ending Medicare as We Know It

- Shredding the Safety Net

- Increased Defense Spending

- What Loopholes Get Closed? That's a Secret!

- Trillions in New Debt

- Slower Economic Growth, More Job Losses

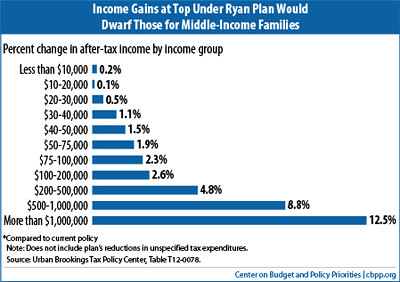

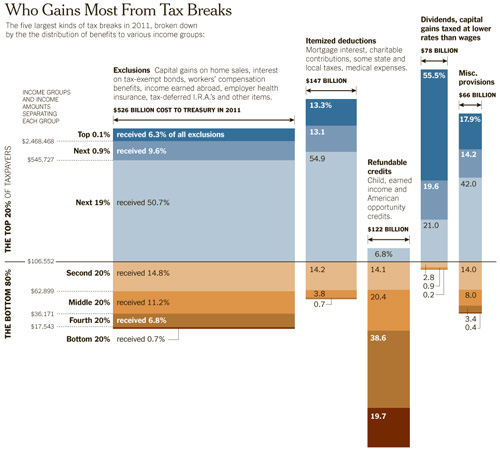

Both Mitt Romney and Paul Ryan would reduce corporate taxes from 35 to 25 percent. The top marginal income tax rate would be slashed from 35 percent to 25 percent (for Ryan) or 28 percent (for Romney). But while the former Massachusetts Governor is offering a 20 percent across-the-board cut to all of the current tax brackets, Ryan wants to move to only two: 10 and 25 percent. Ryan-Romney also ends the AMT and by repealing the Affordable Care, the taxes on higher-earners used to help pay for it. (Both men also want to eliminate the estate tax, a move which could theoretically deliver the Romney heirs an $80 million windfall.)

The result of the Ryan plan is predictable. As ThinkProgress explained:

In all, those tax breaks amount to a $3 trillion giveaway to the richest Americans and corporations, according to the Tax Policy Center. Repealing the repatriation tax would add roughly $130 billion to that.

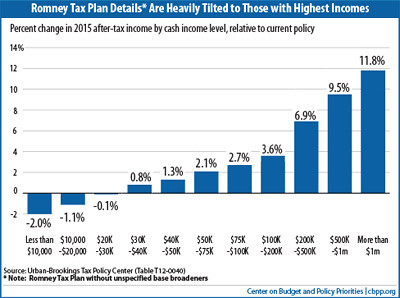

At a time of record income inequality, the lowest federal tax burden in 60 years, Mitt Romney would produce a similar payday for those who need it least. Again, ThinkProgress:

Romney's claim that his plan would promote job and economic growth while reducing the deficit is also likely false. The Bush tax cuts were promoted under the same guise, only to blow a $2.5-trillion hole in the federal budget that was accompanied by worst performance of any post-war expansion" for growth in investment, GDP, and job creation. Romney's tax cuts are even more expensive, clocking in at a cost of more than $10.7 trillion over the next decade and reducing revenue to a paltry 15 percent of GDP, according to Linden. Balancing the budget on those terms, as Romney claims he will do, would be next to impossible.

As it turns out, Romney would hand over 60 percent of the benefits from his tax cuts to the top one percent of earners. And that figure was before he announced his new 20 percent across-the-board tax cut scheme reflected below.

But as a recent analysis by the nonpartisan Tax Policy Center revealed, that chart actually understates just how regressive Romney's tax plan really is. Even after assuming the closure of tax loopholes and deductions which disproportionately favor the rich, TPC forecast that President Romney would cut taxes for the richest five percent of earners while increasing the tax bill for the other 95 percent of Americans. It's no wonder Ezra Klein concluded that "'broadening the base and lowering the rates' is anti-family tax reform," adding:

"The size of the tax cut he's proposing for the rich is larger than all of the tax expenditures that go to the rich put together. As such, it is mathematically impossible for him to keep his promise to make sure the top one percent keeps paying the same or more."

In April 2011, 235 House Republicans and 40 GOP Senators voted for Paul Ryan's plan to convert Medicare into a system of under-funded vouchers in which millions of seniors would be left to the devices of the private insurance marketplace. But when Americans learned that the Ryan scheme would inevitably lead to massive cost-shifting to - and rationing for - the elderly, Paul Ryan went back to the drawing board.

In December, he returned with an updated version of the Ryan-Wyden plan, which would continue a government Medicare as one option. As ThinkProgess explained

Beginning 2023, the guaranteed Medicare benefit would be transformed into a government-financed "premium support" system. Seniors currently under the age of 55 could use their government contribution to purchase insurance from an exchange of private plans or traditional fee-for-service Medicare. But the budget does not take sufficient precautions to prevent insurers from cherry-picking the healthiest beneficiaries from traditional Medicare and leaving sicker applicants to the government. As a result, traditional Medicare costs could skyrocket, forcing even more seniors out of the government program. The budget also adopts a per capita cost cap of GDP growth plus 0.5 percent, without specifying how it would enforce it. This makes it likely that the cap would limit the government contribution provided to beneficiaries and since the proposed growth rate is much slower than the projected growth in health care costs, CBO estimates that new beneficiaries could pay up to $2,200 more by 2030 and up to $8,000 more by 2050. Finally, the budget would also raise Medicare's age of eligibility to 67.

Again, the specifics may vary, but Mitt Romney's prescription for Medicare is essentially the same poison pill as the "Ryden" model. As the New York Times documented in November:

Mr. Romney's proposal would give beneficiaries the option of enrolling in private health care plans, using what he, like Mr. Ryan, called a "premium support system." But unlike the [original] Ryan plan, Mr. Romney's would allow older people to keep traditional Medicare as an option. However, if the existing government program proved more expensive and charged higher premiums, the participants would be responsible for paying the difference.

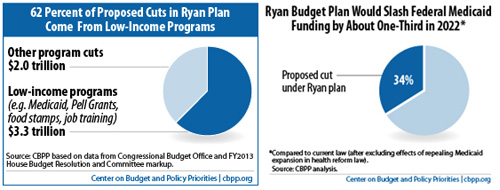

When it comes to Medicaid, food stamps and other key components of the American social safety net, Paul Ryan and Mitt Romney see eye-to-eye. Each would slash Medicaid spending (Ryan by a third) over the next decade, and send the reduced funds to the states in the form of block grants.

Those budget cuts wouldn't merely result in millions of poor, elderly and disabled Americans losing health insurance, but guarantee a nationwide race to the bottom. As Jonathan Cohn explained:

If the law changes and Medicaid becomes a block grant, then every year the federal government would simply give the states a lump sum, set by a fixed formula, and let the states make the most of it. Conservatives claim block grants would give states the flexibility they need to make their programs more efficient. But, as Harold Pollack has noted in these pages, states already have some flexibility. And because demand for Medicaid tends to peak during economic downturns, when state tax revenues fall, the likely impact of a block grant scheme would be to make Medicaid even less affordable at the time it is most necessary.

That's not to say plenty of governors wouldn't take advantage of block grant status to change their Medicaid programs in ways they cannot now. They surely would--by capping enrollment, thinning benefits, increasing co-payments, and so on.

Nevertheless, as Matthew Yglesias documented, Paul Ryan insists that his plan "strengthens the safety net by returning power to the states, which are in the best position to tailor assistance to their specific populations."

Of course, this simply isn't true, as Mitt Romney found out the hard way. Romney explained his devil-may-care attitude towards the 46.2 million Americans now living in poverty and the 51 million more with incomes less than 50 percent above the poverty line:

"I'm not concerned about the very poor. We have a safety net there," Romney told CNN. "If it needs repair, I'll fix it. I'm not concerned about the very rich, they're doing just fine. I'm concerned about the very heart of the America, the 90 percent, 95 percent of Americans who right now are struggling."

That's an odd statement for Mitt Romney to make, and not merely because he previously declared himself part of "the 80 to 90 percent of us" who are middle class. Romney's own economic plan says otherwise.

Romney's isn't worried about fixing the safety net; he wants to shred it. And in December, Chris Wallace of Fox News called him on it.

WALLACE: But you don't think if you cut $700 billion dollars in aid to the states that some people are going to get hurt?

ROMNEY: In the same way that by cutting welfare spending dramatically, I don't think we hurt the poor. In the same way I think cutting Medicaid spending by having it go to the states run more efficiently with less fraud, I don't think will hurt the people that depend on that program for their healthcare.

The Congressional Budget Office says otherwise. Looking at Ryan's new version of shredding the safety net, the CBO estimates 48 million Americans would lose health insurance (32 million from repeal of the Affordable Care Act, 15 million from Medicaid cuts, and another one million from the voucherization of Medicare). It's with good reason Ezra Klein asked, "Should the poor pay for deficit reduction?"

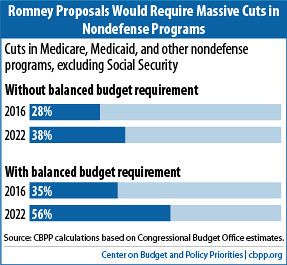

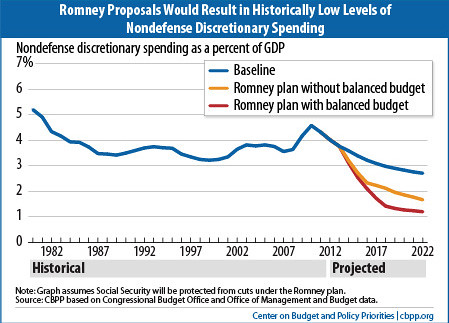

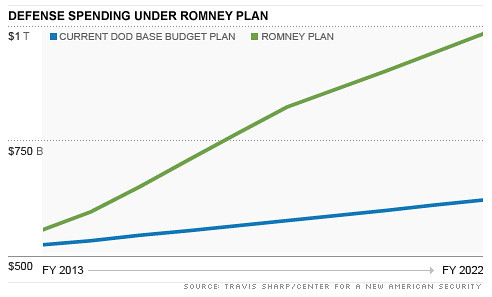

To add insult to injury, both Mitt Romney and Paul Ryan would break the terms of last year's Congressional debt deal by increasing defense spending. As ThinkProgress summed it up:

The Ryan budget protects defense spending from automatic cuts agreed to in last year's debt deal, then boosts defense spending to $554 billion in 2013 -- $8 billion more than agreed upon in the deal. At the same time, it asks six Congressional committees to find $261 billion in cuts. That includes $33.2 billion from the Agriculture Committee, meaning food stamps and other social safety net programs are likely to face cuts, all while the Pentagon remains untouched.

Romney's defense build-up is even more nonsensical. As the Boston Globe noted, Romney not only fails to realize savings from the end of the U.S. war in Afghanistan, but promises Pentagon increases that simply don't square with his pledge to "Cut, Cap and Balance" the federal budget:

Under next year's budget, defense spending is projected to be about 3.2 percent [of GDP] - yet Romney has stuck by his 4 percent vow. Put another way, that means Romney proposes spending 61 percent more than Obama at the end of a decade-long cycle, according to the libertarian Cato Institute.

Enacting such an increase at the same time that Romney wants to slash taxes and balance the budget could cost trillions of dollars and require huge cuts in domestic programs. As Romney's website puts it matter-of-factly, "This will not be a cost-free process.''

While gutting the social safety net in order to fund yet another tax cut payday for the gilded-class, Romney wants to expand U.S. defense spending to its highest level in decades. All told, he would catapult Pentagon spending by $2.1 trillion over the next decade.

What Loopholes Get Closed? That's a Secret!

Balancing the budget from Ryan-Romney is indeed impossible, unless the two-headed Republican beast is willing to make steep cuts to spending and eliminate tax deductions for workers, families and businesses that cost Uncle Sam over $1 trillion a year. But because ending, say, the Earned Income Tax Credit ($63 billion in 2011) or the home mortgage deduction ($89 billion) would be wildly unpopular, neither Ryan nor Romney will volunteer the information.

Appearing on MSNBC's "Morning Joe" in March, Congressman Ryan declared he would "Get rid of the special interest loopholes, special deductions, lower everybody's tax rates, bring in at least as much revenue to the government but grow the economy and create jobs, and get spending under control so we can pay off this debt." But when host Joe Scarborough asked "Which one of those [loopholes] do you eliminate," Ryan said voters won't learn the answer until after the election:

"We want to do this in the light of day and in front of everybody. So the Ways and Means Committee, which is in charge of the tax system, sent us the plan here, which is a 10 and 25 percent bracket for individuals and small businesses, and then they want to have hearings and, in light of day, show how they would go about doing this."

As it turns out, that's the same dodge Mitt Romney used. Earlier this year, his economic adviser Glenn Hubbard admitted Romney's cowardice, explaining "it is not his intention to take on any specific deduction or exclusion and eliminate it." As the New York Times reported:

"In order to limit any impact on the deficit, because I do not want to add to the deficit, and also to make sure we continue to have progressivity in our tax code, I'm going to limit the deductions and exemptions, particularly for high-income folks," Mr. Romney, a former governor of Massachusetts, said. "And by the way, I want to make sure that you understand, for middle-income families, the deductibility of home mortgage interest and charitable contributions, those things will continue," he said. "For high-income folks, we are going to cut back on that, so we make sure that the top 1 percent keeps paying the current share they're paying or more. We want middle-income Americans to be the place we focus our help, because it's middle-income Americans that have been hurt by this Obama economy."

But just two weeks later, Mitt Romney concluded discretion was the better part of valor and refused to reveal which deductions and tax breaks he would end:

"So I haven't laid out all of the details about how we're going to deal with each deduction, so I think it's kind of interesting for the groups to try and score it, because frankly it can't be scored, because those kinds of details will have to be worked out with Congress, and we have a wide array of options."

In response, the Post's Klein could only shake his head:

"Let's be clear on this: A tax plan that can't be scored because it doesn't include sufficient details is not a plan. It's a gesture towards a plan, or a statement of intended direction, or perhaps an unusually wonky daydream. But it's not a plan."

Michael Linden described Ryan's version of the shell game this way, "If the president put out a budget with this level of detail and these kinds of assumptions, people would be up in arms about how ridiculous it is." Or as Nobel Prize-winning New York Times columnist Paul Krugman described Ryan's "Pink Slime Economics":

"The Ryan budget purports to reduce the deficit -- but the alleged deficit reduction depends on the completely unsupported assertion that trillions of dollars in revenue can be found by closing tax loopholes...So which specific loopholes has Mr. Ryan, who issued a 98-page manifesto on behalf of his budget, said he would close?

"None. Not one."

The result, as the numbers clearly show, is that Paul Ryan the budget chairman and Mitt Romney the financier would massively increase the U.S. national debt.

That may seem like a surprising result, given Rep. Ryan's declaration that his mission is to "prevent an explosion of debt from crippling our nation and robbing our children of their future." But even with his draconian budget blueprint that cuts Medicaid by a third, ends Medicare as we know it, adds 48 million people to the ranks of the uninsured and by 2050 would result in ending all non-defense discretionary spending, over the next decade Ryan would unleash torrents of red ink from the U.S. Treasury. Ezra Klein explained how Paul Ryan came up $6.2 trillion short:

The Tax Policy Center looked into the revenue loss associated with House Budget Chairman Paul Ryan's plan to cut the tax code down to two rates of 10 percent and 25 percent. They estimate the changes would raise $31.1 trillion over 10 years, or 15.4 percent of GDP. That's $10 trillion less than the tax code would raise if the Bush tax cuts were allowed to expire, and $4.6 trillion less than it would raise if all of the Bush tax cuts were extended.

"The Republican congressman says he'll "broaden the tax base to maintain revenue...consistent with historical norms of 18 to 19 percent." So let's say Ryan needs to find close-enough deductions and loopholes to hit 18.5 percent of GDP. That means he'd need to close about $6.2 trillion in tax deductions and loopholes over 10 years.

But Ryan evades the responsibility for making the numbers work and taking the heat for ending popular deductions, a role he punts to the House Ways and Means Committee to "show how they would go about doing this." It's no wonder Greg Sargent said Ryan's "Path to Prosperity" plan simply "is not serious" while the New York Times called it "careless."

And one other thing. Over the next 10 years, the Ryan House budget would add substantially more to the national debt than President Obama's proposed 2013 plan.

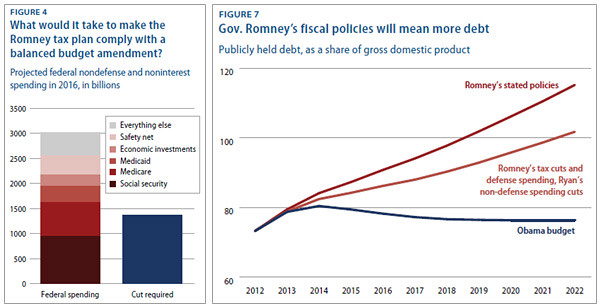

As the Center for American Progress explained, the Congressional Budget Office (CBO) assessment of the Ryan budget "did not test Rep. Ryan's claims about how his policies would actually affect spending or revenue," but "merely showed what would happen to the debt if his claims were true." In a nutshell, they are not:

But the House budget's entire claim to deficit reduction is built on the foundation of those fantasy revenue levels. Without them, the debt goes up, not down. In fact, with all the House budget's tax cuts properly accounted for, revenue would average just 15.3 percent of GDP from 2013 through 2022, not 18.3 percent. The result: deficits would never drop below 4.4 percent of GDP, and would rise to more than 5 percent of GDP by 2022.

The national debt, measured as a share of GDP, would never decline, surpassing 80 percent by 2014, and 90 percent by 2022. By comparison, President Barack Obama's budget proposal, released in February, would stabilize the debt by 2015, and bring it down to 76 percent by 2022.

If this all sounds familiar, it should. Because in February, Mitt Romney also rolled out a new economic plan, one which similarly hemorrhages red ink.

As it turns out, Romney's scheme to "Cut, Cap and Balance" the federal budget does nothing of the sort. As the Washington Post explained in its discussion of an analysis by the Committee for a Responsible Federal Budget, "until the campaign offers a more specific plan, Budget Watch analysts said Romney's entire framework would add about $2.6 trillion to the debt by 2021." (As ThinkProgress and the Washington Post's Lori Montgomery and Ezra Klein all explained, that's likely a conservative estimate.)

In words and in pictures (above), CAP put it this way:

The various fiscal promises Gov. Romney makes simply cannot work together. He cannot simultaneously cut taxes as he's proposed, increase defense spending, protect Social Security and Medicare for current and near-future retirees, and also balance the budget. It is mathematically impossible.

Mathematically impossible and, for the American people, catastrophic.

Slower Economic Growth, More Job Losses

Despite Republican mythmaking that "President Obama made the economy worse," the Ryan and Romney budget blueprints would actually bring economic growth to a screeching halt and with it cast hundreds of thousands of Americans into the ranks of the unemployed.

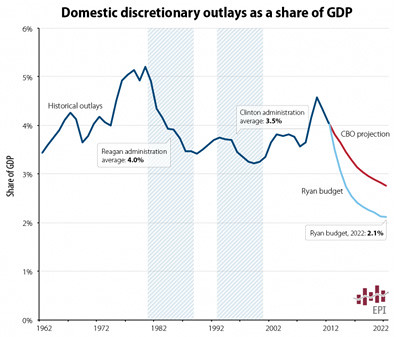

The Economic Policy Institute summed up the carnage the Ryan budget is forecast to produce:

Paul Ryan's latest budget doesn't just fail to address job creation, it aggressively slows job growth. Against a current policy baseline, the budget cuts discretionary programs by about $120 billion over the next two years and mandatory programs by $284 billion, sucking demand out of the economy when it most needs it and leading to job loss. Using a standard macroeconomic model that is consistent with that used by private- and public-sector forecasters, the shock to aggregate demand from near-term spending cuts would result in roughly 1.3 million jobs lost in 2013 and 2.8 million jobs lost in 2014, or 4.1 million jobs through 2014.

Despite his promise to produce 12 million new jobs in his first term, Mitt Romney's vision isn't much better. Many leading economists predict that far from rescuing the middle class, Mitt Romney will only batter it further. Joel Prakken, chairman of economic forecasting firm Macroeconomic Advisers, rejected the notion that Mitt's 159-point plan would "reduce the unemployment rate from eight to five in two years." James Galbraith worried that" if applied, these fiscal measures would be utterly draconian" and "the attacks on Medicare and Social Security would throw large portions of the population into poverty." Mark Hopkins of Moody's Analytics stated that "on net, all of [Romney's] policies would do more harm in the short term," adding, "If we implemented all of his policies, it would push us deeper into recession and make the recovery slower." Nobel Prize-winning economist Paul Krugman lamented, "Ireland is Romney economics in practice. I think Ireland is America's future if Romney is president." As his fellow Nobel winner Joseph Stiglitz put it:

"The Romney plan is going to slow down the economy, worsen the jobs deficit, and significantly increase the likelihood of a recession."

The Center for American Progress put a number on that jobs deficit:

By a conservative tally, Gov. Romney's 59-point plan would actually cost the economy about 360,000 jobs in 2013 alone

That cost of the Romney-Ryan plan is one Americans simply cannot afford.